🔎 The Ultimate Guide to Cardano

Demystifying one of the most enigmatic and important blockchains in Web3

The Cardano blockchain. Just the mere mention of this project is likely to draw in all sorts of opinions from complete opposite ends of the spectrum.

Supporters of Cardano, will argue that it is one of the most well-researched and best designed blockchains in existence. They will also note that any delays in rollouts as a result of this slow and deliberate approach will have been well worth it in the long run.

Meanwhile, skeptics will be quick to claim that despite being launched in 2017, Cardano is lagging behind some newer L1’s in terms of their dapp ecosystem and developer activity.

Given this extreme polarization in stances, Cardano felt like the perfect blockchain for me to explore next.

My mission is to help eliminate “Layer-1 maximalism” in the Web3 space. This means approaching each Layer-1 blockchain with an open mind, and making sure I understand all of the fundamentals before speaking on it.

Over the past 15 days, I went deep on Cardano. Consuming dozens of papers and video explainers, exploring the Cardano dapp and NFT ecosystem, and getting to know members of the Cardano community by hanging out on Twitter & Discord.

Below is the compilation of all of my research and experiences from that time. My hope is that it will give you a better understanding of Cardano and allow you to make your own assessment from an informed view point, rather than following simply following the crowd (on either side).

Note: For insights into how I explore Layer-1 blockchains, check out this article.

The Cardano Tech + Protocol ⚙️

If there’s one area where Cardano has clearly put in the work, it’s in regards to the research and philosophy behind its tech.

The Cardano community prides itself on research, calling itself the first blockchain that is founded on “peer-reviewed researched and developed through evidence-based methods”1 .

You can read through their 139+ papers on the IOHK website. For the purposes of this article, I will attempt to hone in on the most crucial aspects of the blockchain tech and protocol.

For a more in-depth breakdown of the Cardano tech & protocol, I highly recommend this article by Tecmeup.

What is Cardano in simple terms?

The Cardano blockchain network is an open-source, permissionless, layer-1 blockchain based on Proof-of-Stake (PoS). It is considered a “third-generation blockchain”2, in that it implements smart contracts while also solving for fundamental issues faced by second-generation blockchains such as scaling, interoperability, and sustainability.

What unique problem is Cardano trying to solve better than its competitors?

The Cardano founding team believed there were major flaws with how Bitcoin and Ethereum (the two most popular blockchains) were implemented. Specifically, they felt that Bitcoin’s lack of a smart contract functionality limited it’s ability to solve for a wide variety of use-cases, while Ethereum’s initial implementation has clear issues around scalability and resulting high fees.3

Cardano’s aim is to try to take the best aspects of first and second-generation blockchains, while fixing the downsides mentioned above.

How is the Cardano blockchain protocol (Ouroboros) implemented?

Cardano refers to its underlying protocol by the name of “Ouroboros”. There are a lot of implications to the Ouroboros protocol & it’s subsequent updates, which I recommend reading into if you have time.

The most important aspects to understand about Ouroboros is that it takes after Bitcoin in leveraging Nakamotostyle consensus, i.e. the nodes in the network will follow the longest chain when deciding to append new transactions to the ledger.

However, where Ouroboros differs from Bitcoin’s consensus mechanism, is that rather than using compute power to decide who has the right to be the leader(i.e.Proof of Work), it leverages Proof of Stake. As a reminder, in general PoS consensus, participants stake the native asset for the right to make updates to the ledger, and the odds of being selected are based on the quantity (and amount of time) assets have been staked by a validator.

To help incentivize participants to stake their assets, validators receive rewards in the form of the native currency. In the case of Cardano, the native currency “ADA” is both the currency staked and awarded to validators.

There are a few specific aspects to the way that Cardano implements PoS that I think are worth pointing out as well:

When you stake ADA, your assets are not actually locked and they don’t undergo a “cool off period” when you unstake.

Cardano’s PoS does not implement “slashing”, in other words, if the stake pool operator (SPO) misbehaves, the delegators don’t lose their assets as punishment.

The staking requirement for Cardano is only 1 ADA (to cover the UTXO minimum).

Delegators can continue to leverage their ADA from within smart contracts (I.e. they can use their assets in dapps while still being a delegator).

Lastly, staking pools are a crucial part of Cardano’s PoS model, however we will cover that under community, because as we will see, this is a driver of sub-communities within Cardano.

What are the hardware requirements for nodes? How decentralized is the network?

It’s important to note that the term “node” can take on various meanings in regards to the Cardano blockchain network.4

Node (generally): Is any device running software that participates in validating Cardano transactions.

Stake pool: A set of highly reliable Cardano nodes (I.e. has high up time) that people can delegate their ADA into. Not only does it does it validate transactions on the network, but it also has the ability to produce new blocks.

Block producer node: A producer node is a node within the stakepool on which the blocks are actually minted. Each stakepool must have at least producer node.

Relay node: A node that does not have any keys, and cannot produce blocks as a result. Instead, relays act as proxies between the core network nodes and the internet, establishing a security perimeter around the core, block-producing network nodes.

According to IOHK website, below are the minimum requirements for SPO’s5 👇

The low hardware + staking requirements, has resulted in Cardano being one of the most decentralized blockchains in existence with over 3,193 stake pools and no single stake pool having more than 12% of total ADA staked6 (which is currently over 70% of the total circulating supply).

$ADA utility + Tokenomics

The native token of the Cardano network is $ADA. Aside from being used to incentivize validators to maintain the network, it also can be used for a number of other activities including: Paying transaction fees, buying CNFTs, and on a variety of DeFi apps.

It appears that one of the primary reasons for Cardano’s strong community support stems from the fact that they have had a much more “fair launch” in terms of their initial token allocation than other Layer-1 blockchains. Specifically, over 80% of the initial supply of 25.9 billion ADA, was distributed through public sales from 2015-20177.

This stands in stark contrast to many recent L1s, who have seen large insider rounds for teams & VCs, which are often dumped on retail investors who only have access at higher prices.

The supply of ADA will be capped at 45 billion, with the current circulating supply sitting at around 33.8 billion, leaving roughly 11 billion for network incentives8.

What language is the core blockchain written in? Is it EVM compatible?

Cardano chose to use a functional programming language known as Haskell for developing its core blockchain.

Functional programming languages differ from object-oriented programming languages such as Java, Python, Rust, etc. For a full breakdown of the differences between FP and OOP languages you can check out this article.

The Cardano team chose to go with a FP language since it uses immutable data which makes it more safe and secure, which they argue is crucial for a blockchain network. The downside to this approach is that it has meant a smaller pool of developers to pull from. For instance, less than 1% of the active users on the Github source repository use it.9

The above said, Cardano did start supporting smart contracts with its Alonzo hard fork in September, 2021. Cardano refers to its smart contract platform as Plutus, and is also working on a no-code smart contract option for financial contracts called Marlowe.

Lastly, Cardano has supposedly become EVM compatible through its Milkomeda EVM sidechain, which would allow interoperability of smart contracts between Ethereum and Cardano10. This would be massive for adoption, given Ethereum’s current grip on the overall Web3 developer community. However, I am unsure how widely adopted this sidechain is at the time of this writing.

Tech Summary

As you can probably see by now, the Cardano Foundation has left no stone unturned when considering how to built their blockchain & protocol.

There were many aspects I left out of this article including the 5 eras of the Cardano roadmap, the fine-grained details of their staking distribution (including epochs), the EUTXO model, native tokens, sidechains and more.

I intentionally chose not to go deeper for a number of reasons. The first is that 99% of people would have lost interest (if they haven’t already). This is one of the few knocks I have against Cardano, which is that the foundation/community tends to lean into unnecessarily esoteric language at times & struggle’s to leverage Pareto’s principle when describing their tech.

Put another way, I believe the Cardano Foundation needs to get better at highlighting the key elements of their tech & protocol that make it much better than the competitors. In my eyes it can be summed up even more concisely than my relatively brief overview above.

The Cardano dapp + NFT Ecosystem 📱

Historically, most of the criticisms around Cardano have not been about the research and philosophy behind its tech; but rather, their inability to apply/implement that tech.

It doesn’t matter how many fancy words you use or the number of research papers you write, if you don’t have a robust ecosystem of dapps and users leveraging them, then nothing else really matters.

Up until a few quarters ago, one could have made a legitimate case that Cardano was a “ghost chain” to some degree, in that there were no dapps live. However, I was pleasantly surprised to find that development efforts have picked up rapidly.

It appears that it doesn’t matter that Cardano was a bit late to the dapp party, since there were so many developers and community members on the sidelines that once the floodgates opened, a lot of ground was made up in no time.

I spent some time exploring the different dapps and NFT collections already live on Cardano and will go over some high level insights I learned from then.

Cardano Wallets

It’s nice to see that Cardano already has a number of different wallet providers available on their network. When I posed the question of which Cardano wallet to use on Twitter, the 3 most commonly referenced wallets were: Nami, Eternl, and GeroWallet.

Given that it is tedious to set up a bunch of different wallets, I only set up wallets with Nami and Eternl. Overall, while both of these wallets checked the boxes for most of my basic needs, both were severely lacking when it came to UX/usability.

I did a Twitter thread on the ways in which I believe that Nami’s wallet experience can be improved, but suffice it to say, that I haven’t found a Cardano wallet yet that is on par with wallets like Phantom, MetaMask, Coinbase wallet, etc.

For instance, many of the top wallets on other chains not only having really sleek interfaces, but they also have native mobile app support on iOS (note Eternl is native mobile support, but its UX is rough).

I believe that it is VERY important that an A+ Cardano wallet provider emerges in the near future, to make it easier for the masses to onboard to its dapp ecosystem. This wallet has to be supported by a full-team and not just individual developers (no matter how brilliant), as wallets are simply too crucial to the onboarding experience of any blockchain ecosystem.

Cardano dapp ecosystem

In contrast to a blockchain like Solana, Cardano seems to put a lot less emphasis on its dapp ecosytem on its website. I was told this is to help promote decentralization in their ecosystem, however, it did add friction to the search experience.

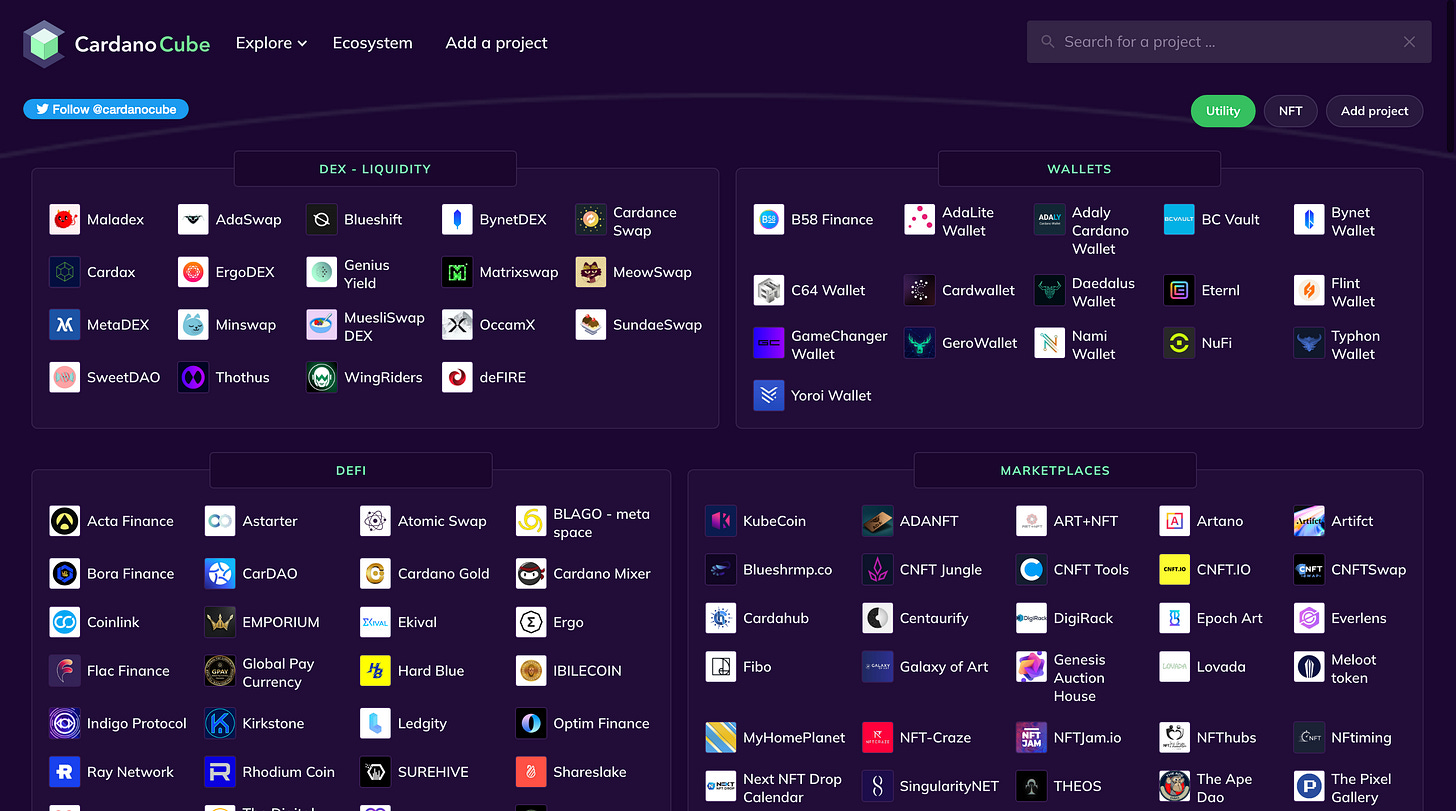

One resource I did find extremely useful was Cardano Cube, which is a website that highlights all the dapps in the Cardano ecosystem.

I had a chance to use a number of different dapps built on Cardano, here were my findings.

DeFi apps

When it comes to DeFi apps there are only a few things I truly care about as an end user: Usability/UX, Yield, and Trust.

Like most early dapp ecosystems, Cardano dapps still leave a lot to be desired on these fronts, however there are some strong signs of early progress here.

For instance, SundaeSwap and Minswap have a UX that is on par with some of the top DEXs I’ve seen across all of Web3. Their biggest problem these apps face right now is less a fault of their own; but rather, the lack of many well-known Cardano project tokens to create pools with, and a much lower TVL than blockchains like Ethereum.

TVL matters, because it provides liquidity depth, which makes it a less volatile experience for users. To put it into perspective, the top pool on SundaeSwap only has a TVL of ~$5M, which is only half of the TVL of the 50th largest pool on Uniswap11.

Note: Many people have pointed out that while Cardano has less TVL than other blockchains based on DeFillama, this does not take into account the 70%+ of ADA that is staked into the protocol.

There are also a few other important tools that Cardano needs for a great DeFi experience that are still on the way. For instance, Cardano lacks a prominent stablecoin on the network at the current time. Granted, DJED is on the way, and holds a lot of promise. However, given the recent UST collapse, I do have some concerns with the fact they are using an algorithmic stablecoin. My hope is that Cardano can take a more careful approach than the Luna Foundation did, but I remain cautious.

Similarly, Cardano mixer, could provide a needed privacy angle for Cardano, but again the project is still in development and not in production yet.

There are many other DeFi apps I played around with, and I believe they will all benefit as the core pieces I laid out above continue to rollout or improve in the coming quarters.

Web3 Apps

A lot of blockchains are still hyper-focused on DeFi apps, but I am personally more interested in other use-cases such as Web3 social, Metaverse, DAOs, gaming etc. emerging in the future.

As far as I can tell, Cardano hasn’t had a breakout Web3 app like Solana has had with StepN or HIVE/WAX has had with Splinterlands, however very few blockchains can claim to have one. Not to mention, it remains to be seen if those popular apps will have any true staying power with users.

Overall, my current take on Cardano Web3 apps is that it is still a bit too early to form a strong opinion on them. Many of the most promising looking social, gaming or metaverse projects like Cardano Village or Peepsule are still in development.

It will be interesting to see after the Vasil hardfork, which of the dapps will emerge from being just concepts on paper to truly sticky apps.

NFT Collections + Marketplaces

One area where Cardano does seem to be having solid traction with users is in their NFT (or CNFT) ecosystem. This is how many blockchain networks have bootstrapped their initial active userbase, so this is a promising trend for Cardano.

As of this past week, Cardano is already doing the 3rd largest volume of any layer-1 blockchain, which is impressive considering that NFTs on Cardano are still relatively new.

I picked up a few CNFTs for myself including a Yummi Universe and Claypez, which I now have displayed on my Pixl Page.

I expect Cardano NFTs to experience breakout growth in the coming quarters as more of Cardano’s passionate community moves their funds into these collections. An integration with the likes of OpenSea and/or Coinbase NFT could really send their prices soaring.

But even without one of these integrations, Cardano looks well-positioned with really strong NFT marketplaces of its own including Jpg.store (my favorite), as well as CNFT.io and Cardahub.

Cardano dapp ecosystem summary

Overall, I was pleasantly surprised by how many different projects have already launched on Cardano or are currently in development.

While I would still put their consumer ecosystem behind others in the space, I expect Cardano to make up a lot of ground over the coming year with their strong community of users and developers who will be eager to jump on board.

Lastly, it’s worth mentioning that Cardano has made some serious progress on the commercial front with serious partnerships with the likes of Wolfram, Dish network, and Rival.

The Cardano Community 🤝

I truly feel that the secret sauce behind the Cardano blockchain is its community, which I believe to be one of, if not the strongest, in all of crypto. This makes sense considering that Cardano has remained one of the top projects by MC despite going years without having dapps live.

To prove this point I’d like to provide a mix of both anecdotal as well as quantitative evidence.

On the personal front, I’ve received insanely high engagement on all of my tweets on Twitter, with the community quick to respond to any question or feedback I had. This isn’t just for show or “bots” either. I’ve had many engaging conversations through DMs + on Twitter spaces and will be meeting members of the community at events like Consensus 2022.

This is a community that cares deeply about educating/helping others. Many of them have stayed around while receiving a ton of hate and FUD from others, so I don’t expect that to change as Cardano starts to pick up more momentum.

Network adoption

Aside from just my subjective takes, there is also a lot of hard data on the blockchain that proves the Cardano community is continuing to lean in and engage.

According to data by Cardano.fans, there have already been 3.3M+ wallets created on the network, along with 1.1M+ unique delegators, and the network is now processing over 100,000 transactions on a typical day.

Staking & Governance

As I mentioned earlier, Cardano has seen massive adoption with its staking program, with over 70% of the circulating supply staked.

Most of this is driven around Cardano staking pools. One thing that I found fascinating about Cardano is that the staking pools are actually very communal in nature.

Some staking pools even have their own mission or token, and many even have their own Twitter handle or Discord servers for members to hang out with each other in.

Aside from earning yield on staked ADA and building community, members can also participate in governance on the Cardano blockchain. New tools like Project Catalyst and ideascale, allow ADA holders to actually help dictate the direction of the network. Few blockchains have put this same level of attention on governance.

Cardano Team

I would be remiss if I didn’t make a short remark on the Cardano core team. Cardano is currently organized into 3 primary organizations: Cardano Foundation, IOG, and EMURGO, all of which serve unique purposes.

Across the board, each of these organizations have strong teams of proven operators and some of the best minds in the space.

Not to mention, Charles Hoskinson, the Ethereum co-founder who serves as the heartbeat of the Cardano community and the CEO of IOG, is a force in the space. I highly recommend anyone who is interested in Cardano to listen to some of his talks, as he probably embodies the culture of Cardano better than anyone. Not to mention, he is someone that has clearly thought about almost every angle of blockchain networks.

Conclusion

While I only intended to research Cardano for about a week, I ended up spending over 2 weeks learning about and engaging with this project. A lot of this has to do with the fact that Cardano is one of the most complex and multi-faceted blockchains in the entire space.

Unlike many of the new challenger Layer-1s, Cardano has years of history behind it that are worth unpacking and exploring. During this time Cardano has helped introduce many new ideas and concepts that has benefitted not only their own blockchain, but also the wider Web3 space as a whole.

In return for this diligent work over the years, Cardano has built a strong community of holders, developers, and now active users.

Moving forward, the clear alpha for Cardano will be slightly pivoting away from its more research-oriented roots to focus much more on its end users and the applications on its blockchain.

Furthermore, Cardano could benefit from making its technology and ecosystem more approachable in general. This article is actually a great example of how complex Cardano currently is right now.

As a researcher, I was bombarded with so much content and information, that it was at times difficult to sift through and figure out which were the most critical pieces of information to know about Cardano.

The above being said, I can definitely say I now understand the appeal of Cardano. From the research, to the budding dapp ecosystem, and passionate community, it’s a blockchain everyone in the space should dive into at some point.

Overall, I am more informed about blockchains and Web3 as a result of this process, and I am excited to see what this next phase of Cardano brings from an engagement standpoint

All of the pieces are now in place for Cardano, now it’s just a matter of bringing it to the masses.

-Alex Valaitis

I don’t charge any $ for my content, but if you want to support me, here’s 3 different ways that you can:

1)Tip me in ADA, tokens or NFTs at my ADA handle (I promise to keep it all within the Cardano ecosystem) 👇

2)Subscribe to this newsletter ‘Web3 Pills’ :

3)Follow me on Twitter: @Alex_Valaitis

Disclaimers:

None of the information above is meant to be financial advice. Please DYOR.

I hold ADA, but it’s currently a small % of my crypto net worth (for now).

https://cardano.org/

https://www.ledger.com/academy/blockchain/web-3-the-three-blockchain-generations

It’s worth noting that Bitcoin is trying to solve for these gaps with its lightning network, while Ethereum is attempting to solve their gaps with the move to Ethereum 2.0

Leaned heavily on this subreddit thread to define these terms: https://www.reddit.com/r/cardano/comments/q0pxga/what_is_the_difference_between_a_node_and_a_stake/

https://iohk.zendesk.com/hc/en-us/articles/900001208966-Stake-Pool-Minimum-System-Requirements

https://www.statista.com/statistics/1279280/cardano-ada-biggest-staking-pool-groups/

https://messari.io/asset/Cardano/profile/launch-and-initial-token-distribution

https://www.coingecko.com/en/coins/cardano

https://www.benfrederickson.com/ranking-programming-languages-by-github-users/

https://cardanofeed.com/cardano-gains-evm-compatibility-with-ethereum-dapps-through-milkomeda-62142.html#:~:text=Cardano%20has%20become%20EVM%2Dcompatible,pressure%20to%20the%20ADA%20asset.

https://info.uniswap.org/#/pools

Photo of Charles doesn’t align with what you have written about him. I suggest a second photo at the opposite extreme and either acknowledge that he is a polarising figure or explain that he is unafraid to act with little regard to how he may be misjudged.

nicely summarised. hope to hear your take on Zilliqa in the near future