Welcome to Web3 pills, the daily crypto newsletter that’s here to help you grow your crypto knowledge, even when crypto prices seem scary 👻

Here are your 💊’s for today:

97.7% of tokens on Uniswap are scams - Report

Vitalik warns crypto community to pump the brakes on institutional adoption

Trending articles

NFT of the day

🎃 No tricks just treats. If you’re enjoying Web3 Pills, consider sharing this FREE newsletter with a friend so they can also learn more about crypto.

97.7% of tokens on Uniswap are scams

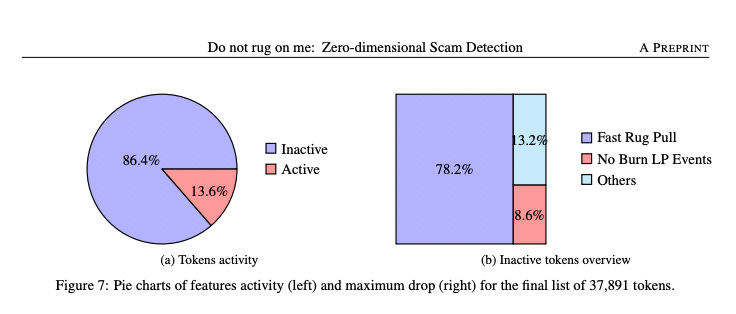

According to a recent research report, the vast majority of tokens on the popular Ethereum DEX Uniswap, are actually rug pulls.

For those who are not familiar, a rug pull refers to when a team launches a token, promises a certain set of deliverables to help sell more of the tokens, and then abandons the project without actually delivering.

The research team created their own machine learning model to classify which tokens were deemed rug pulls.

Out of the 27,588 labeled tokens on Uniswap, only 631 were labeled as non-malicious tokens, while a whopping 26,957 were labeled as malicious. This means that over 97% of all tokens on Uniswap are actually malicious.🤯

Obviously this statistic is extremely concerning, but there’s a few things we can learn from this data:

The anonymous nature of crypto can have downsides: When people do not have their public reputation tied to a project, they are much more likely to abandon.

Launching a token is easy, building a successful crypto project is hard: Even for the projects that did not start with bad intent, it’s clear from this data that it is difficult to find product-market fit. Whereas, a token only takes a few lines of code.

DEX’s are less vetted than CEX’s: Unlike centralized exchanges like Coinbase and Binance, Uniswap does not vet tokens. On the one hand, this makes their product decentralized and permissionless. On the other, it makes the product dangerous for inexperienced traders.

Certain parts of crypto remain the wild west, and Uniswap is a perfect example. While there are still hundreds of legitimate projects, it’s clear that these are few and far between.

Looks like ghosts and goblins aren’t the only thing we need to fear this Halloween. Stay safe out there.

VITALIK WARNS CRYPTO COMMUNITY TO PUMP THE BREAKS ON INSTITUTIONAL ADOPTION

One of the most prominent figures in the crypto space has decided to get more vocal in regards to the crypto regulation discussion.

Coming on the heels of a contentious online debate that broke out on Twitter after FTX founder Sam Bankman-Fried published controversial regulation proposals, Ethereum co-founder Vitalik Buterin is sounding off with his take.

Normally a much more reserved figure, it appears that Vitalik recognizes the gravity of the current moment in regards to crypto regulations.

The past few months have seen regulators getting much more aggressive with its crypto policies, particularly the SEC with its crack down on DeFi projects.

In a twitter thread, Vitalik pointed out the perils of pursuing large institutional capital. Specifically, he suggested that institutional investment is a double-edged sword:

👍 The good side of institutional investments: Brings more capital and participants to the industry.

👎 The bad side of institutional investments: Many of the institutions are demanding stricter regulations on crypto in order to participate. This can erode the DNA of crypto and even eliminate the key value props that make it better than the existing financial system.

We align strongly with Vitalik’s points on crypto regulation. New regulations such as forcing DeFi dApps to KYC their users or participate in censorship would remove the permissionless, censorship-resistant and decentralized nature of crypto.

Similar to Vitalik, we would prefer to see the space develop more slowly, but stick to its core value props that got the industry to the place it is at now.

TRENDING ARTICLES

Dogecoin Futures Rack Up Nearly $90M in Liquidations Over Weekend in Unusual Move: There’s some $647 billion of open interest on dogecoin futures as of Monday.

Ether ticks above $1,600 as crypto-related earnings take center stage: It’s a big week for crypto earnings.

Bitcoin Miner Argo's $27M Fundraise Falls Through; Shares Plunge: The bitcoin mining industry is battling soaring energy prices coupled with the stagnated value of cryptocurrencies.

NFT OF THE DAY

In the NFT space, there are some collections that are known for their high quality art, while others are known for their communities and/or utility. And then there are the NFT collections that are known for just being ridiculous.

At the top of the list of ridiculous NFT collections is a collection called ‘CryptoDickbutts’. Yes you read that correctly.

While the project actually has a decent website, the thing that has actually propelled this collection to the top of the charts, is the fact that it has won the hearts of those in crypto meme culture.

While the crypto industry is working on solving some very important problems, sometimes it’s nice not to take yourself too seriously and have some fun.

⚠️P.S. If you feel like being disturbed, check out this art piece from NFT artist Beeple. (WARNING: THIS IS NOT FOR THE FAINT OF HEART, DO NOT CLICK UNLESS YOU WANT TO BE DEEPLY DISTURBED)⚠️