GM. Welcome to Web3 pills, the daily crypto newsletter that helps you hodl for dear life.

Here are your 💊’s for today:

PayPal threatens to fine customers $2,500 for ‘misinformation’

Are NFT royalties dying?

Trending articles

NFT of the Day

PAYPAL THREATENS TO FINE CUSTOMERS $2,500 FOR ‘MISINFORMATION’

One of the core tenant’s of Bitcoin (and crypto in general), is the idea of ‘financial sovereignty’, or having complete ownership and control over your assets. If you control the private keys to your Bitcoin wallet, then you have complete control over your assets.

For crypto skeptics, this value proposition can often feel underwhelming or even unnecessary. After all, who wants to be responsible for the added stress and effort that comes with having to guard your own assets?

However; every so often, we get an important reminder of why the pursuit of financial sovereignty is such an important one…

Enter PayPal.

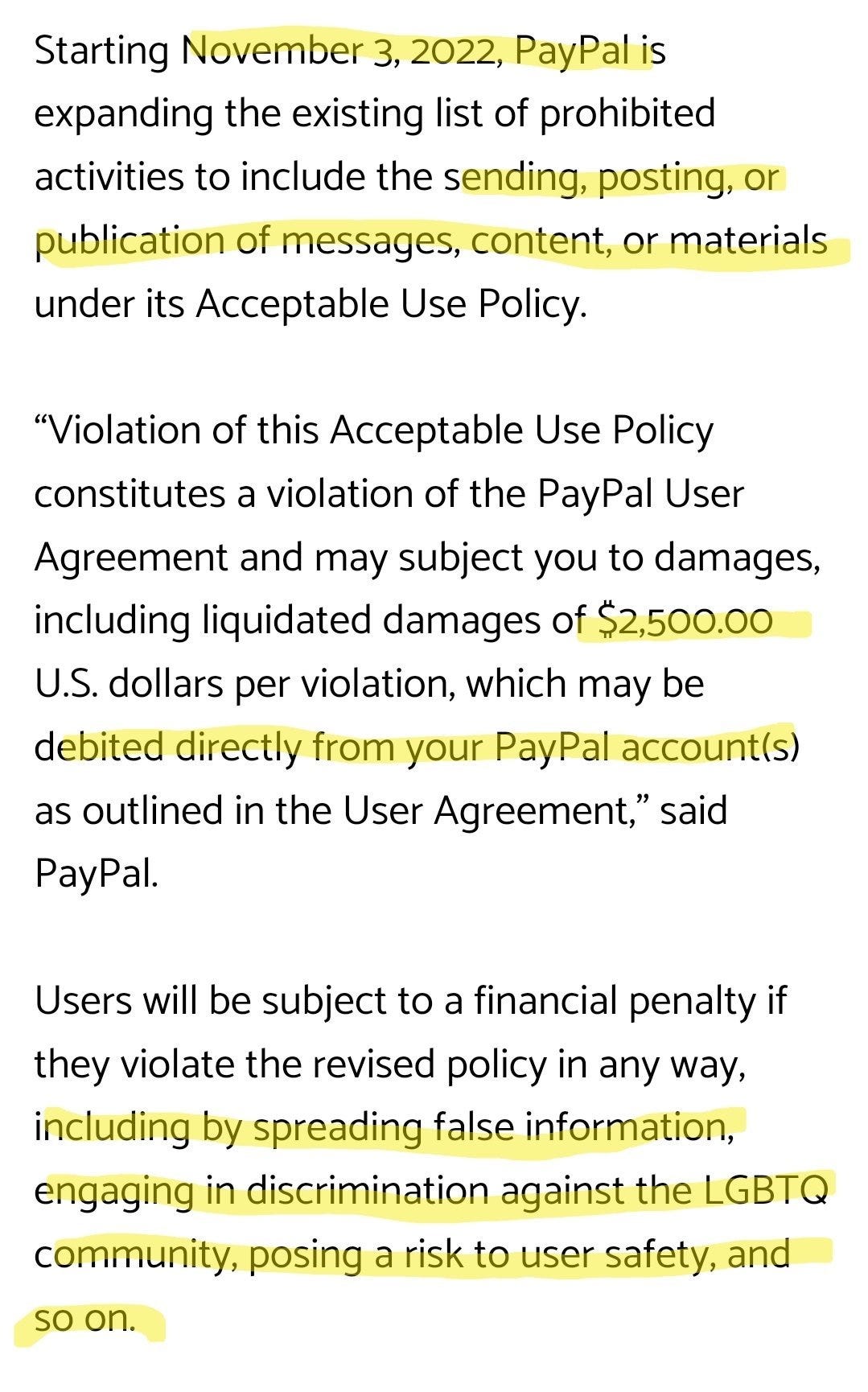

On Saturday, a news story broke that payments company PayPal had published an update to it’s Acceptable Use Policy, stating that it would fine users $2,500 for promoting misinformation:

This shocking update was immediately condemned by many, including by some of the key early leaders of the “PayPal Mafia” such as David Sacks, and Elon Musk:

I think it’s important to understand why this update was met with so much backlash. For starters, the debate on ‘misinformation’ has become a heated one in recent months. During the COVID pandemic, social media companies began taking a more active approach towards taking down what they felt to be ‘misinformation’ spreading online.

However, this policy began to raise concerns among many independent thinkers. For instance, who are the people that get to decide what is actually ‘misinformation’? Is it actually a balanced panel of informed individuals, or a homogenous group of thinkers that are trying to push a specific agenda?

Not to mention, as we saw on many occasions with COVID, things that were initially touted as ‘misinformation’ by the media, later turned out to be 100% true.

Social media censorship is already concerning; however, PayPal took it to another level with this policy update. The audacity it takes for a company to autonomously take YOUR money out of YOUR own account, based on some opaque process that they have for determining misinformation is INSANE.

While PayPal quickly tried to backpedal on the policy, we should not give them the benefit of the doubt. In order for this policy to have seen the light of day, it had to be proposed, drafted and approved by numerous groups of people. I would go as far as to say that this was a test run, and had the social reaction been different, they might have even kept it.

As we see an increasingly greater concentration of power in social media, tech, and finance, it’s important to keep in mind that technologies such as crypto may just be our last hope in reversing this trend.

Lastly, I think it goes without saying that you should definitely consider taking your money off of PayPal if you value it.

ARE NFT ROYALTIES DYING?

Over the weekend, the NFT Royalties debate was reignited after a surprise announcement of 0% royalties from DeGods, one of the top collections on Solana:

For those that aren’t familiar with the NFT Royalties model, here’s a quick overview.

On most NFT marketplaces (such as OpenSea), NFT collections have the opportunity to set what is known as creator royalties/earnings, on secondary sales of any NFT in its collection.

What this means is that if an NFT transaction takes place between 2 parties, the NFT marketplace will automatically take a % of that sale (ranging from 2.5-10%) and send it to a wallet of the team.

It’s important to note, that these fees are enforced by the NFT marketplaces themselves, since it can’t be programmed into an NFT collections on a smart contract level. This means that transactions such as “Over the Counter” or OTC trades can bypass these fees.

In recent months, we’ve seen NFT marketplaces popping up that do not support royalties, and we now have a unique situation in which a major NFT collection is willingly opting out of them. So what should we make of all of this?

Proponents of NFT royalties argue that royalties have been one of the unique selling points for attracting creators & artists into Web3. Historically, these groups have been criminally under compensated for their work by the Web2 model, in which all of the value tends to accrue to large companies.

By allowing creators/teams to make $ on each secondary sale, it allows them to participate in the upside and benefit from the value creation of their work. This money can then be used to help these creators and teams scale their operations and move forward.

Meanwhile, critics of NFT royalties argue that these additional charges are unfair and going to undeserving creators and/or teams.

Some people believe the charges are unfair, since they already paid an upfront price for the NFT. If the asset appreciates in value, shouldn’t that be their right to fully capture the upside since they took the initial risk to purchase and are now the owner?

Additionally, many skeptics have pointed to cases in which nefarious teams have made a lot of $ off of the initial sale, but then abandoned the projects, all while continuing to collect royalties from an active community.

So, what is the right answer here?

While this may not be a satisfying answer for many people, my opinion is that it depends. Given the wide range of quality in the NFT collection, it’s hard to take a one-size-fits-all approach.

For instance, if an NFT collection is framed as being solely about the art from Day 1, then I believe royalties make a lot of sense. However, if a team is planning to build out a wider business and/or community around the collection, then I think royalties make less sense. This is because royalties are NOT a sustainable long-term revenue model IMO. Since it is predicated on users wanting to leave the collection, which creates perverse incentives.

Overall, I think we are still in just the first inning with NFTs. Perhaps a new model will emerge that will be better for BOTH NFT artists and communities that hasn’t been thought of yet.

TRENDING ARTICLES

[The Block] Resy co-founder Ben Leventhal raises $11 million for new web3 hospitality platform: Web3 hospitality platform Blackbird has raised $11 million in a seed round, co-led by Union Square Ventures, Shine Capital and Multicoin Capital.

[CoinDesk] It's Lonely in the Metaverse: Decentraland’s 38 Daily Active Users in a $1.3B Ecosystem: While metaverse platforms Decentraland and The Sandbox both have below 1,000 daily active users, they each have over $1 billion in valuation. So who's actually using the metaverse right now?

[Decrypt] Bitcoin Mining Difficulty Jumps 14%, Hitting All-Time High: Monday’s difficulty hike is the single largest since May when it rose by 22%.

NFT OF THE DAY

One of the blockchain ecosystems that continues to gain momentum is Cosmos. Cosmos is a network of different blockchains and allows for application-based blockchains. For instance, Stargaze blockchain, is a blockchain custom-built for NFT use cases.

Here is an NFT from one of the top collections on Cosmos called ‘Stargaze Punks’. Stargaze Punks #2311 is 1 of 8,888 in the collection and is rocking the Osmosis logo (another Cosmos blockchain) on its shirt.