🔎 The Ultimate Guide to Solana

A deep dive into one of the hottest layer-1 blockchains of the past year

When I was debating which layer-1 blockchain to explore first as part of my new experiment, it felt obvious that I needed to start with Solana.

It feels like no challenger layer-1 has drawn more attention over the last 18 months than Solana. Yet despite all of the hype, I realized that I had very little working knowledge of this blockchain.

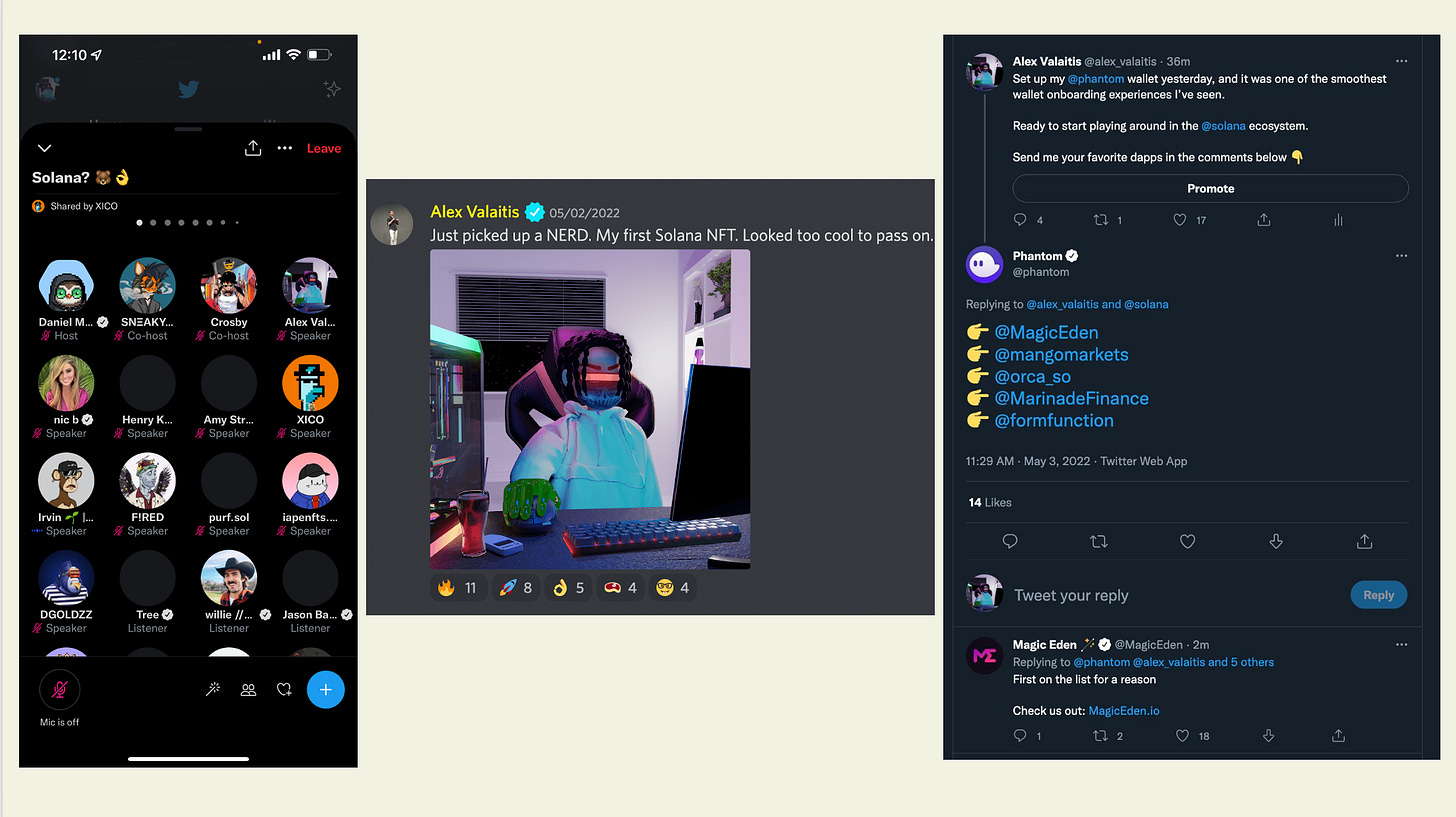

Over the past 7 days I allowed myself to become completely consumed by Solana. I tried different dapps, bought Solana NFTs, hopped on Twitter spaces until 2 am, and even joined a DAO.

At the end of my research I felt 100x more knowledgeable about this blockchain, and I am excited to share what I learned with all of you in this article.

Note: For insights into how I explore Layer-1 blockchains, check out this article.

The Solana Tech ⚙️

As is the case with any new Layer-1 I explore, I began by diving into the blockchain tech and protocol mechanics.

Below were the primary resources I used to build a base understanding of the tech:

Across these resources, I was able to answer the following fundamental questions about Solana’s tech:

What unique problem is this L1 trying to do better than its competitors?

As the Ethereum blockchain has grown in popularity, it has struggled to scale its transactions per second (tps) at a rate that can keep up with demand.

In the wake of DeFi summer, users felt these pains first hand in the form of slower confirmation times and high gas costs, which left the door open for a better user experience.

In simple terms, Solana seeks to be the most performant blockchain by scaling its tps to high levels, which in turn reduces both settlement time and costs for its participants.

Theoretically, Solana believes its network can support up to 65,000+ tps, which crushes Ethereum’s current tps of 30 tps (but this could theoretically rise to 100K tps with Ethereum 2.0). Solana also has an average transaction cost of only $0.00025.

What mechanism(s) does the protocol use to reach consensus?

The way that Solana delivers on this value prop is largely through its consensus model. Unlike Bitcoin and Ethereum which still leverage Proof-of-Work*, Solana relies on Proof-of-Stake.

In addition to leveraging PoS, Solana implemented a unique aspect to its protocol called Proof-of-History. PoH, essentially allows for all nodes in the network to align to a shared clock in an efficient way, which is something other blockchain networks struggle with.

I recommend diving into this Medium article by the founder Anatoly, that describes the 8 key innovations that make the Solana network possible in more detail.

*Note: With Ethereum 2.0, the network will shift to PoS.

What are the hardware requirements for nodes? How decentralized is the network?

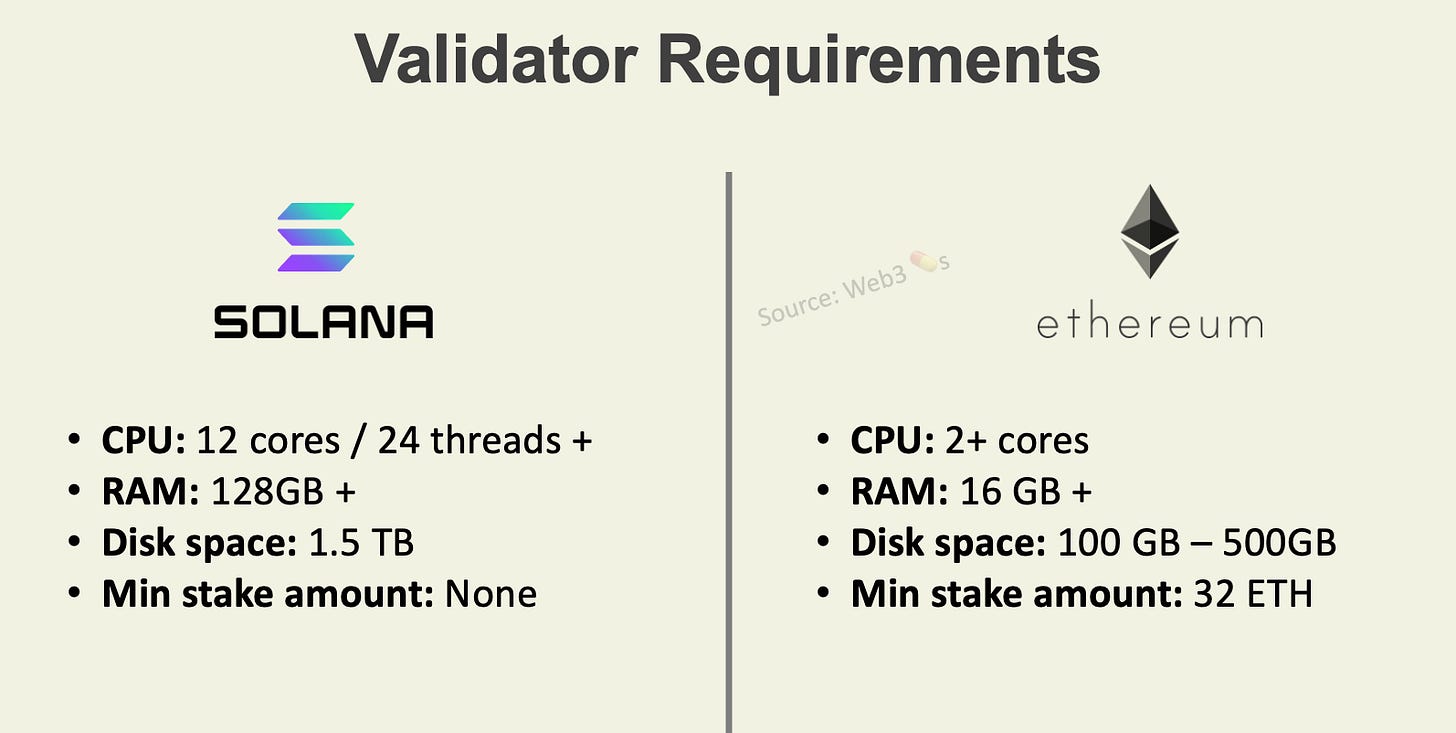

According to the Solana website, the hardware requirements to run a validator node are as follows (as compared to Ethereum):

Since Solana has higher validator requirements than Ethereum overall, this has led to it having significantly less active validators. Currently Solana claims 1,700+ validators in comparison to Ethereum’s 300,000+ validators.

Note: When people talk about Solana being ‘centralized’ this is one of the primary pieces of evidence that they point to.

What are the tokenomics?

The native coin for the Solana network is SOL. It is used for activities such as incentivizing network participants (through staking), paying transaction fees, buying Solana NFTs, and as a token pair to trade with on different Solana DEXs.

According to Coinmarketcap, SOL has a circulating supply of 335,186,968 SOL, a total supply of 511,616,946 SOL, and no established maximum supply at the time of this writing.

Solana has both inflationary as well as deflationary forces at play. The largest source of inflation is from staking rewards payouts, which started at 8% and reduces a little every epoch (full inflation schedule here).

On the deflationary side, a percent of every transaction fee is burned, which means that if tps were high enough, it could technically push Solana to 0% inflation (or even net deflationary). However, it’s safe to assume that Solana will remain somewhat inflationary for the next few years.

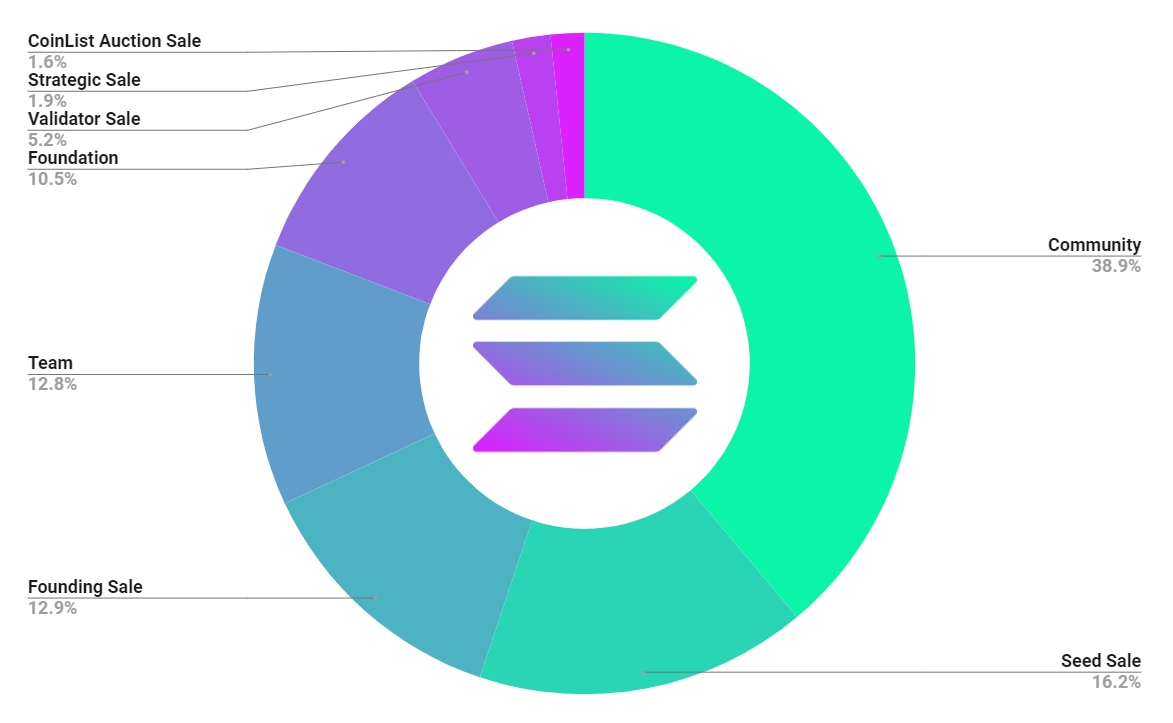

When it comes to Solana’s initial token distribution, it is true that there was a high concentration devoted to “insiders” (team, VCs, etc) of around 48%. However, it is also worth noting that around 39% is devoted to community/ecosystem funds, which Solana has been very aggressive with deploying.

In a perfect world, you’d like to see greater distribution of SOL via public sales; however, this is the reality of the Solana distribution. So long as the community allocation continues to be deployed both strategically & aggressively back into the ecosystem, we could see this distribution eventually balance out. Alternatively, these skewed tokenomics could eventually come back to haunt the network if ecosystem momentum is not able to overcome the sales from insiders.

What language is the core blockchain written in? Is it EVM compatible, etc. ?

Solana refers to their smart contracts as “programs”. To deploy programs, developers must use a programming language called Rust. Personally, I think this creates a barrier to entry for developers as Rust isn’t a very popular language. However, I’m not an active software developer so this might be a misinformed opinion.

In terms of EVM compatibility; historically, Solana has not been EVM compatible (meaning developers cannot leverage smart contracts from Ethereum), however that seems to be changing with the work by Neon Labs to make Solana EVM compatible.

Who are the team?

The Solana founding team consists of 5 members, most notably Anatoly Yakovenko (CEO of Solana Labs), Rajiv Gokal (COO of Solana Labs), and Greg Fitzgerald (CTO of Solana Labs). The founders have deep experience across bluechip tech companies like Qualcomm and Google.

The Solana team has also expanded aggressively over the past 18 months with over 220+ employees listed on the Solana Labs LinkedIn page.

Tech Summary

Ethereum’s delayed rollout of Ethereum 2.0 clearly left the door open, and Solana’s tech does manifest positive benefits for its users.

Being PoS (with PoH baked in) from the start has resulted in low transaction fees and high speeds, which has allowed Solana to bring in many new users that were priced out by Ethereum.

While the centralization around validators, SOL distribution, and recent network outages are concerning, I do believe this is surmountable by Solana assuming they can continue to make updates to the protocol and move towards progressive decentralization.

The Solana dapp + NFT Ecosystem 📱

It doesn’t matter how great a Layer-1s technology is if there aren’t compelling dapps launched on top of the network.

Luckily in the case of Solana, there is already a thriving ecosystem of dapps. Part of this has to do with Solana’s aggressive deployment of capital through its ecosystem funds, as well as its investment in core infrastructure for apps like Solana Pay.

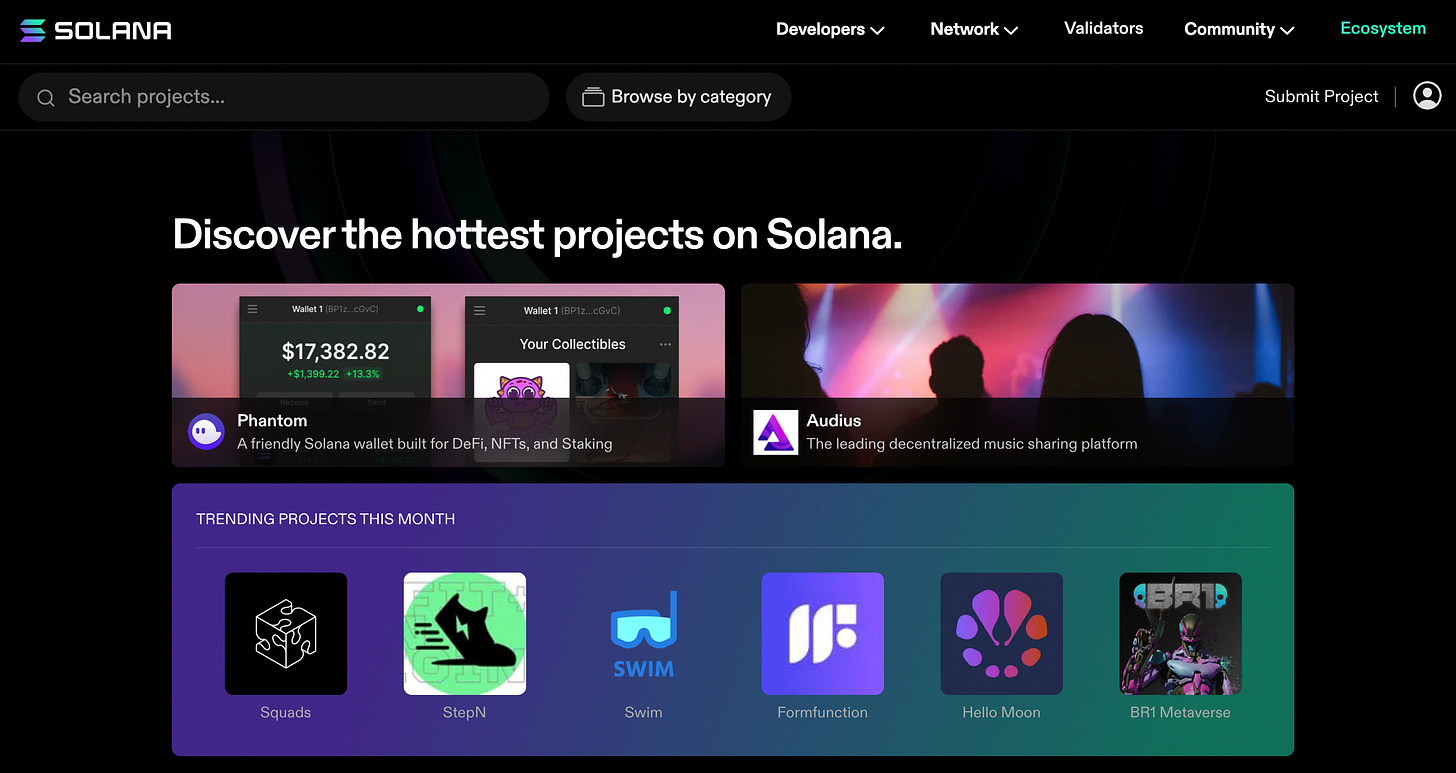

Another important aspect is that Solana does a fantastic job of highlighting its app ecosystem.

On the Solana ecosystem page, users can browse 100s of Solana dapps, filter by different categories and even upvote their favorite projects.

Exploring Solana dapps is near frictionless with plenty of solid wallet providers. Solana lists over 70 wallets on their website, but I personally chose to go with Phantom.

I loved that Phantom not only has a browser extension but also a slick native mobile app to go along with it. I set up my Phantom wallet & moved over some of my SOL that I had sitting in Coinbase since early 2021 in just a few min. Here are some of the observations I had across the dapp ecosystem.

DeFi apps

With most of my experience with DeFi coming from Ethereum, using Solana was a breath of fresh air in many ways. The low transaction fees allowed me to test dapps in away that would have been impossible on Ethereum layer 1.

There were plenty of different DeFi apps to choose from (300+ listed on Solana’s ecosystem page) but a few common trends stood out among the apps.

The first, was that the bar for UX on most Solana dapps seemed very high. A lot of this probably has to do with the fact that Solana developers could leverage the existing solutions on other blockchains to save time and build derivatives of the originals. Nonetheless, it’s clear that most teams care deeply about UX.

Take Orca, a Solana DEX for instance. They’ve included features like a 'fair price indicator' and token balance module on the screen, both of which are features I’m not used to seeing on Ethereum DEXs.

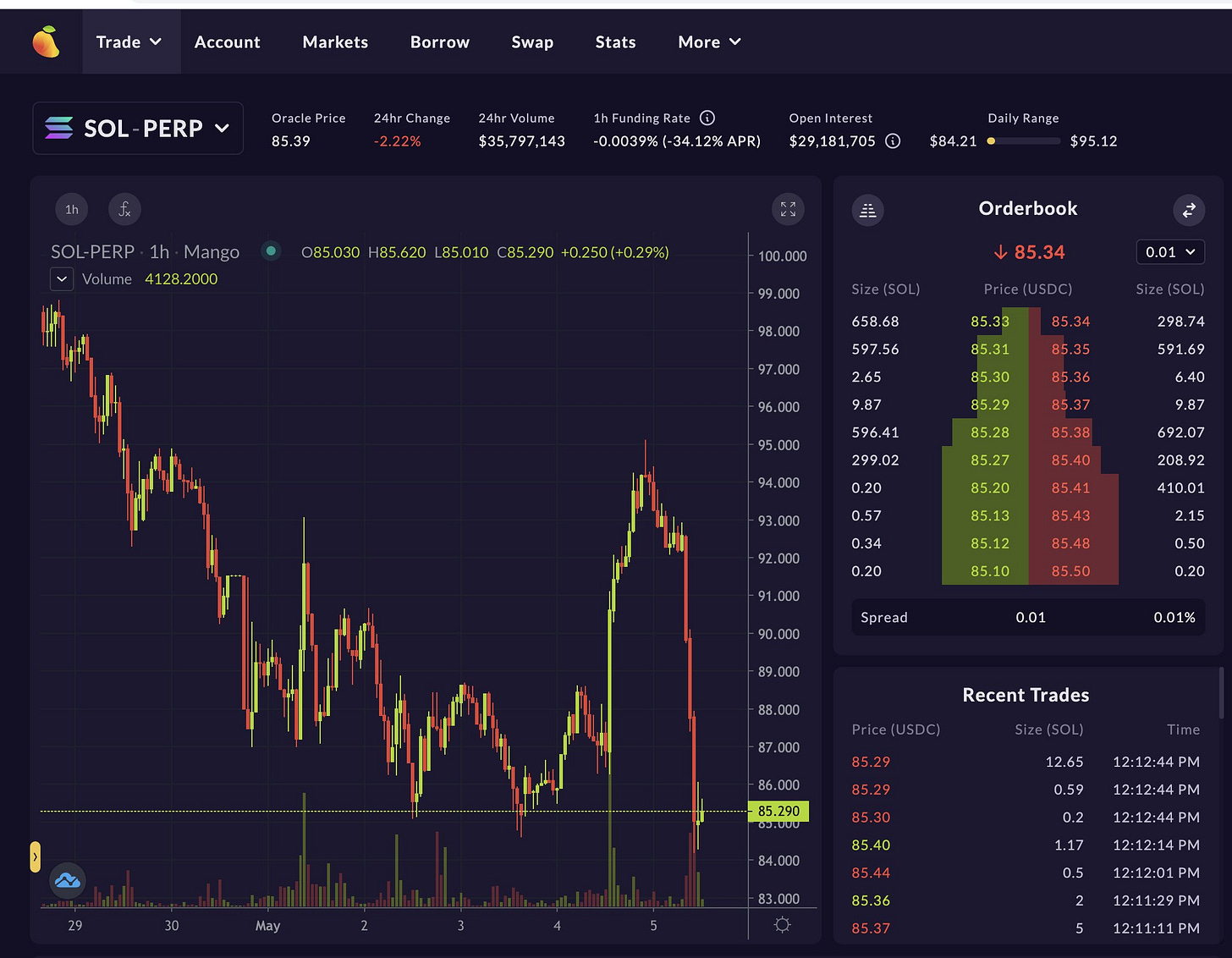

The second, was that Solana’s low fees unlocked interesting new DeFi use cases. Mango has launched a permissionless on-chain orderbook, which is something I had never seen before & is only possible on a network with low fees.

Lastly, it appears that many of the typical DeFi use-cases such as borrow-lend protocols, yield farming, liquidity mining, etc. were available across the ecosystem. While I probably would need to dive deeper to get a better read on which blockchain offers higher yield opportunities on average, the reality is that most APY’s across Web3 are not sustainable. Which means Solana’s low fees should theoretically provide an advantage over more expensive Layer-1s, as DeFi users can quickly move their funds to find the best yield opportunities at any given point in time.

While Solana certainly has the infrastructure to support a healthy DeFi ecosystem, the DeFi culture didn’t seem quite as prevalent as on Ethereum, and the TVL is still lower. However, it would not be unreasonable to see this flip in the future, and there are plenty of opportunities for Solana DeFi users in the mean time.

Web3 apps

Another thing that immediately stood out to me about the Solana ecosystem, was the pure variety of dapps they had available. A lot of blockchain ecosystems seem hyper-focused on DeFi, but Solana teams have done a good job of pushing the envelope of what is possible with Web3 technologies.

Like the industry as a whole, many of the Web3 dapps available on Solana are still half-baked and struggle to provide clear value over their Web2 competitors. Take for instance Audius, which is a music streaming platform built on blockchain technology. While Solana heavily features Audius in their marketing materials, Audius isn’t really live on Solana in any meaningful capacity at this point (the plan is to move their CMS system to Solana over the next year).

All of this being said, there were still some very interesting use-cases available on Solana. Perhaps the most exciting Web3 app I explored on Solana was StepN.

StepN is part of a new category of dapps referred to as “move to earn”. Users download the StepN app, purchase a StepN NFT, and then go on walks/runs with the app tracking their location to earn GMT tokens. While the pricey NFTs ($1.2K for the lowest option) and questionable tokenomics (down 36% since I first downloaded the app) will likely scare off a lot of potential users, it was a glimpse into what the future of Web3 dapps could look like.

NFTs

The last area of the Solana ecosystem I explored was Solana NFTs. I actually picked a great time to explore them since big players like OpenSea have recently integrated with Solana, and hot new collections like Okay Bears were topping the charts across all blockchains. Not to mention Solana also has its own popular decentralized NFT marketplaces like Magic Eden.

There’s no denying that NFTs have played a crucial role in bringing new users to crypto, and they represent a great avenue for new Layer-1s to draw attention (and capital) from incumbents.

It was fascinating watching the impact that the recent rise of Solana NFT collections has had on the wider crypto community sentiment. For instance, I saw numerous tweets by Ethereum influencers/whales who were buying into collections like Okay Bears (presumably via transfers of ETH).

Solana is now the clear number 2 in the NFT space to only Ethereum, and these new collections coupled with an easy onboarding experience, could kick off a new wave of NFT interest that is fueled by a mix of new Web3 users + Ethereum whales bridging funds over in search of more asymmetric bets.

The Solana Community 🤝

Without a doubt, my favorite part of exploring Solana was getting a chance to embed myself into the Solana community.

From the moment I tweeted that I would be exploring the Solana blockchain, it was clear that this was a community that was filled with welcoming members.

Whether it was the Phantom and Magic Eden accounts tweeting app suggestions to me within minutes, hanging with the 404 fam in the DYOR Nerds Discord, or people like Daniel Mateö inviting me on stage of his Twitter spaces to chat with others, I never felt like I was not welcome in the Solana community.

Aside from online interactions, I also noticed that Solana had a strong presence at every major crypto event I attended this past year including Hackweek Miami, SXSW, BTC Miami, etc. They are also investing heavily in their Solana Hacker House World Tour (I was accepted to the ATX house in June), and ongoing global hackathons such as Breakpoint coming in November.

More than the technology or dapp ecosystem, I believe that this is Solana’s true secret sauce. Solana has recognized that blockchains are only as strong as their communities, and they’ve built this into their culture from day 1.

This will provide massive amounts of alpha as other blockchains continue to scare off would-be entrants by either using intentionally esoteric language and/or displaying toxic tribalism that is unbecoming to those not deep in the space.

Conclusion

At the end of my week-long exploration into Solana I was left with overwhelmingly positive feelings towards the Solana ecosystem and community. For a long time, I had clung to the belief that Ethereum was the only serious Layer-1 blockchain, and that these new layer-1s were making unnecessary tradeoffs around decentralization.

However, my exploration of Solana made me realize that this was a very close-minded mindset for me to have. The reality is that Web3 is still inaccessible to the vast majority of people in the world.

Solana has made deliberate tradeoffs around decentralization in order to lower these barriers to entry, and in the short term their strategy is clearly working. By having a performant blockchain with high speeds and low costs, more users can enter the Web3 space for the first time.

This is turn has attracted talented teams and developers, who are drawn to the opportunity to launch dapps that can solve for these users. The end result is an impressive flywheel of talent, capital, dapps, and community that has propelled Solana to the top of the industry.

Whether or not Solana can both maintain and build upon this early momentum remains to be seen, but one thing is for sure, Solana is here to stay and the Web3 movement will become stronger because of it.

-Alex Valaitis

Curious to know your thoughts on how they plan on preventing bot attacks on NFT’s with such low transactions fees in place? If something like what recently happened on Magic Eden that overwhelmed the network and had to be stopped and restarted. How would they plan to resolve this without raising the fees? 🤔

Thanks! I'm looking forward to the sequel 😊